Are Business Meals Deductible 2019

And meals and entertainment for business purposes are a legitimate business tax deduction but there are limits on what you can deduct. 2020 meals and entertainment deductions list.

Irs Makes Clear That Most Business Meals Still 50 Deductible

Irs Makes Clear That Most Business Meals Still 50 Deductible

Business meals with clients.

Are business meals deductible 2019. Washington the internal revenue service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act tcja. As discussed earlier you can deduct 50 of the cost of business meals. Top 25 tax deductions for small business.

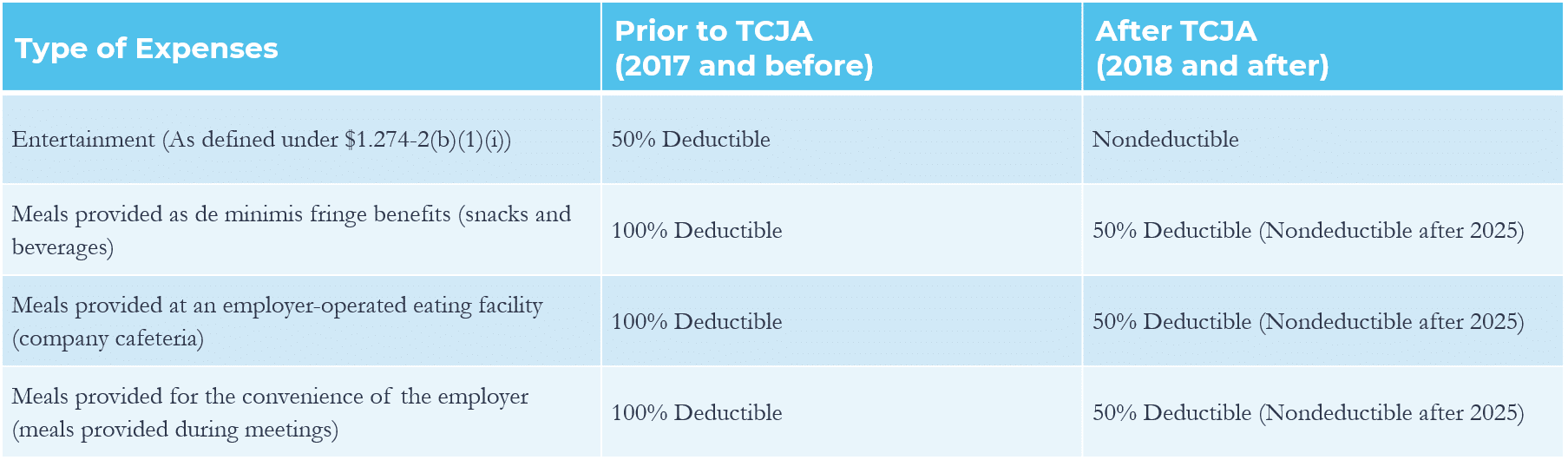

As a small business you can deduct 50 percent of food and drink purchases that qualify. To qualify the meal. The tax cuts and jobs act of 2017 tcja eliminated the deduction for entertainment purchased as a business expense but left intact the deduction for business meals.

In general you can deduct only 50 of your business related meal expenses unless an exception applies. Ir 2020 39 february 24 2020. Small businesses can write off a number of expenses as tax deductions to help lower the amount they owe on their income tax.

2019 new rules entertaining clients concert tickets golf games etc 50 deductible. Because entertainment and meals are often closely intertwined when purchased in a business context taxpayers may have difficulty distinguishing deductible meal expenses from nondeductible entertainment expenses. The tcja eliminated business deductions for entertainment amusement or recreation irc sec.

Until the irs publishes its proposed regulations businesses may deduct 50 of business meal. Business meals with clients 50 office snacks and other food items 50 the cost of meals while traveling for work 50. For decades taxpayers could partly deduct the cost of business related meals.

Wondering what you can still deduct on your 2019 taxes. Yet many feared the tax cuts and jobs act tcja eliminated this deduction starting january 1 2018. The top small business tax deductions include.

Office snacks and meals. 115 97 changed the rules for the deduction of business entertainment expenses. Generally may continue to deduct 50 of the food and beverage expenses associated with operating their trade or business deductible requirements.

The 2017 tcja eliminated the deduction for any expenses related to activities generally considered entertainment amusement or recreation. All of the following are expenses you can subtract from your year end tax bill either by 50 or 100 percent. 274 a this includes most things you d think of like entertainment and may fear that also.

2019 new meals and entertainment deduction requirements. The 2017 tax cuts and jobs act has made major changes in the deduction of meals and entertainment expenses beginning with the 2018 tax year and going forward. If you are subject to the department of transportation s hours of service limits you can deduct 80 of your business related meal expenses.

Roberta 2019 01 23t11 21 34 08 00 jan 23. See individuals subject to hours of service limits later. For amounts incurred or paid after 2017 no business deduction is allowed for any item generally considered to be entertainment amusement or recreation.

Business Meals And Entertainment Expenses 2018 Irs Guidelines

Business Meals And Entertainment Expenses 2018 Irs Guidelines

Deducting Business Meal Expenses Under Today S Tax Rules

Deducting Business Meal Expenses Under Today S Tax Rules

How To Legally Write Off Your Vacation In 2020 Dinner

How To Legally Write Off Your Vacation In 2020 Dinner

Blog Business Expense Bookkeeping Business Small Business

Blog Business Expense Bookkeeping Business Small Business

Navigating The New Meals And Entertainment Deductions Under Tcja

Navigating The New Meals And Entertainment Deductions Under Tcja

Want To Deduct Your Personal Meals Well That S What Maurice

Want To Deduct Your Personal Meals Well That S What Maurice

When Can You Deduct Business Meals Thompson Greenspon Cpa

When Can You Deduct Business Meals Thompson Greenspon Cpa

How To Handle Food And Meals Expenses For 2018 Food Small

How To Handle Food And Meals Expenses For 2018 Food Small

New Tax Law Takes A Bite Out Of The Meals Entertainment Tax

New Tax Law Takes A Bite Out Of The Meals Entertainment Tax

Remember Those Amazing Meals You Had With Clients This Will No

Remember Those Amazing Meals You Had With Clients This Will No

Taxes You Can Write Off When You Work From Home 10 Workfromhome

Taxes You Can Write Off When You Work From Home 10 Workfromhome

Tax Deduction Information Figure A Are My Points Fully

Tax Deduction Information Figure A Are My Points Fully

Meals Expense Update For 2018 And Tcja Tax Deductions Llc

Meals Expense Update For 2018 And Tcja Tax Deductions Llc

Tax Deductions Good List Of Ideas Fixing Up My Office And Using

Tax Deductions Good List Of Ideas Fixing Up My Office And Using

Otrdeductibleexpensesws1 2 Jpg 1472 1647 Business Tax

Otrdeductibleexpensesws1 2 Jpg 1472 1647 Business Tax

2018 Tax Change Alert Some Job Related Expenses Are No Longer

2018 Tax Change Alert Some Job Related Expenses Are No Longer

Komentar

Posting Komentar